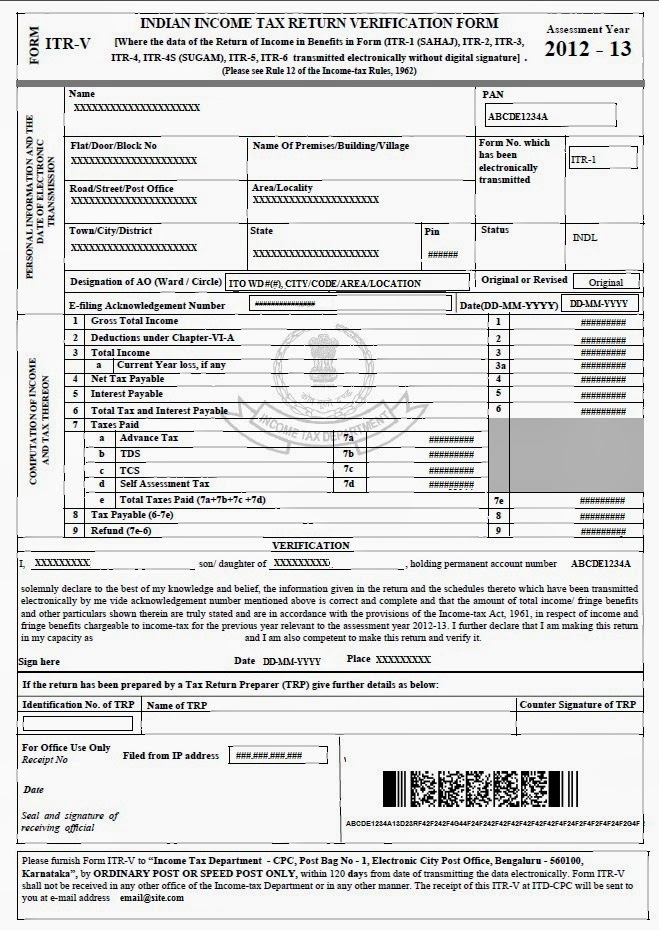

Start from uploading your Form 16 and filing your returns. This means, that you will have to redo the entire process all over again. If you fail to verify your returns, the income tax department would consider your return filed as invalid. While this might seem as a non-significant step in the process, but it can halt your tax return process temporarily or even permanently. Irrespective of which method you choose, it is important that a taxpayer files his/her return and verifies the return as well. How to download ITR-V you ask ? Here are the steps to do the same. But if you haven’t received it, you can manually download the form. What should be the next course of action in such cases? The income tax department usually takes about 2-3 days to post the ITR-V. There have been several instances where taxpayers have not received ITR-V in registered email id. You must post the form within 120 days of receiving ITR-V from the income tax department. The obvious next question would be, where to send ITR-V ? Well, the Income Tax department has made it easier.Īt the bottom of your ITR-V, you can see the address of the Centralized Processing Centre, Bengaluru. You must then sign the document, which essentially confirms that have initiated a tax return process and are aware of the same. Now it is your responsibility to download ITR-V and print ITR-V. Once you do, the income tax department will provide you with an acknowledgement or ITR-V. It can be a bit time consuming and requires inputs from your end.Īlternatively, you can use myITreturn’s platform t quickly file your tax returns. When you are ready with your tax return, you can visit the income tax department’s e-filing website to file your returns. The income tax department has done well to convert most of the steps associated with tax return filing into electronic format.

On successful verification of the return from your end, the income tax department would start processing the return. The income tax department would then send an acknowledgment that they have received your return. These actions do not only ensure that your tax return is complete without any roadblocks but also make sure that your return is not tagged as invalid.įirstly, you need to file your tax returns within the stipulated deadline, which usually is the end of July. There are three major steps when it comes to filing of your taxes and when done in the same order, you have a higher chance of completing your tax-related duties.

Being a resident of the country along with earning more than the minimum threshold of INR 2,50,000 during a fiscal year are the most prominent ones. Filing taxes is a mandatory affair in the country, as long as you meet some basic eligibility criteria.

0 kommentar(er)

0 kommentar(er)